To the Engineer or Tech Professional Who's Serious About Retiring Comfortably at an Early Age Through Real Estate:

"Give Me 6 Weeks and you'll walk away with your first cashflowing out-of-state rental property under contract!"

We don't live off of savings... We live off of CASHFLOW!

...start building yours today!

Stop locking away your savings for 30 years and giving up all control of your money to somebody else while it gets ravaged by inflation and market crashes.

Instead, invest in hard assets that provide passive income TODAY and FOREVER.

Read on to see how you can get expert help to confidently start building a profitable real estate portfolio today using only your existing compensation, and without sacrificing time or energy from a demanding career.

Confidently Buy Real Estate in Locations That Make Sense...

...Without Diverting Time or Energy from a Demanding Career.

Want to invest in real estate, but there’s nothing in your area that pencils out, and you don’t know where or how to find good cashflowing properties?

Introducing the 'Turnkey Mastery System' featuring the '6 Weeks to Cashflow Challenge', where you’ll benefit from all of the following:

Follow my step-by-step process to easily buy out-of-state rental properties that cashflow on day 1.

Leverage my boots-on-the-ground experience to BUY RIGHT: Buy the right property, in the right location, from the right seller, to minimize overall risk.

Learn my engineering-focused process to find, analyze, and buy properties that make sense.

Gain access to Weekly Coaching Calls while you’re going through the program.

Gain membership in a community of like-minded investors to share experiences and wins.

.....all by dedicating just a few hours per week to investment activities.

Imagine...

Systematically building passive income through regular acquisition of rental properties, using only your existing bonuses, RSU's, stock grants, and profit sharing.

Having a predictable path to retiring comfortably at an early age, by knowing when your passive income will exceed your expenses as you continue scaling your portfolio.

Reducing your investment risk by leveraging the 4 profit pillars of real estate investment: Income, Appreciation, Leverage, and Tax Savings.

Capitalizing on these 4 profit pillars to achieve returns that can far exceed those of a 401(k).

Getting off the stock market and global economy roller coaster, and making inflation work FOR you instead of against you for a change!

Taking complete control over your investments.

Receiving hand-holding through the process of buying your first out-of-state rental property, and utilizing that knowledge as a foundation to scale up to a portfolio of 10, 20, or 30 properties and beyond.

This program is for upper middle class professionals who make 6 figures, and (incorrectly) assume that scaling a sizeable real estate portfolio is only for the super wealthy.

The truth is, real estate investing is now more accessible than ever!

In fact, buying your first cashflowing rental property can be done with as little as a $25k investment.

It doesn’t matter if you already own some rental properties, or if you have yet to make your first real estate investment; this program will provide invaluable help for people of all experience levels.

NOTE: There is no magic here; this process requires down payments and bank loans, so this is NOT for people who have difficulty in saving investment capital, or struggle with employment or bad credit. There is no ‘get rich quick’ here; this program is about helping those who are able to save significant sums of money, to utilize that savings to systematically build generational wealth through the regular acquisition of nice properties in nice areas.

Do You Have These Problems Buying Real Estate?

Maybe you already own real estate and love its benefits and want to buy more.

Or maybe you’re just frustrated with traditional investments, and tired of your retirement funds being at the whim of the global economy and a worldwide crash once every decade.

Or maybe both! Regardless of the reason, you’re here because you are at least somewhat aware of the multiple benefits of owning real estate, and want to invest in profitable, cashflowing real estate properties.

But when you look to invest in your local market, what do you find? Do any of these scenarios look familiar?

Ridiculously high prices.

Negative cashflow.

Properties that need MAJOR repairs.

Must self-manage to minimize expenses (tenants and toilets, yuck!)

Restrictive landlord/tenant laws.

All of this means that investing in most real estate markets provides a very limited list of lousy options for those who want to get into real estate.

Your options are generally limited to:

Buying a crappy house and devoting months to a major rehab.

Devoting time and resources to large marketing campaigns to find motivated sellers.

Paying a massive down payment of 50% or more to achieve positive cashflow, locking up hundreds of thousands of dollars in a single property, leaving no ability to scale a portfolio.

Living with negative cashflow for years until market rents increase to even more obscene levels.

Bottom line: You want to enjoy all the benefits of a cashflowing real estate portfolio, but you see no way to make that possible in your local area.

My Solution

I teach people to buy RIGHT, and maximize their probability of success when purchasing an out-of-state turnkey rental property.

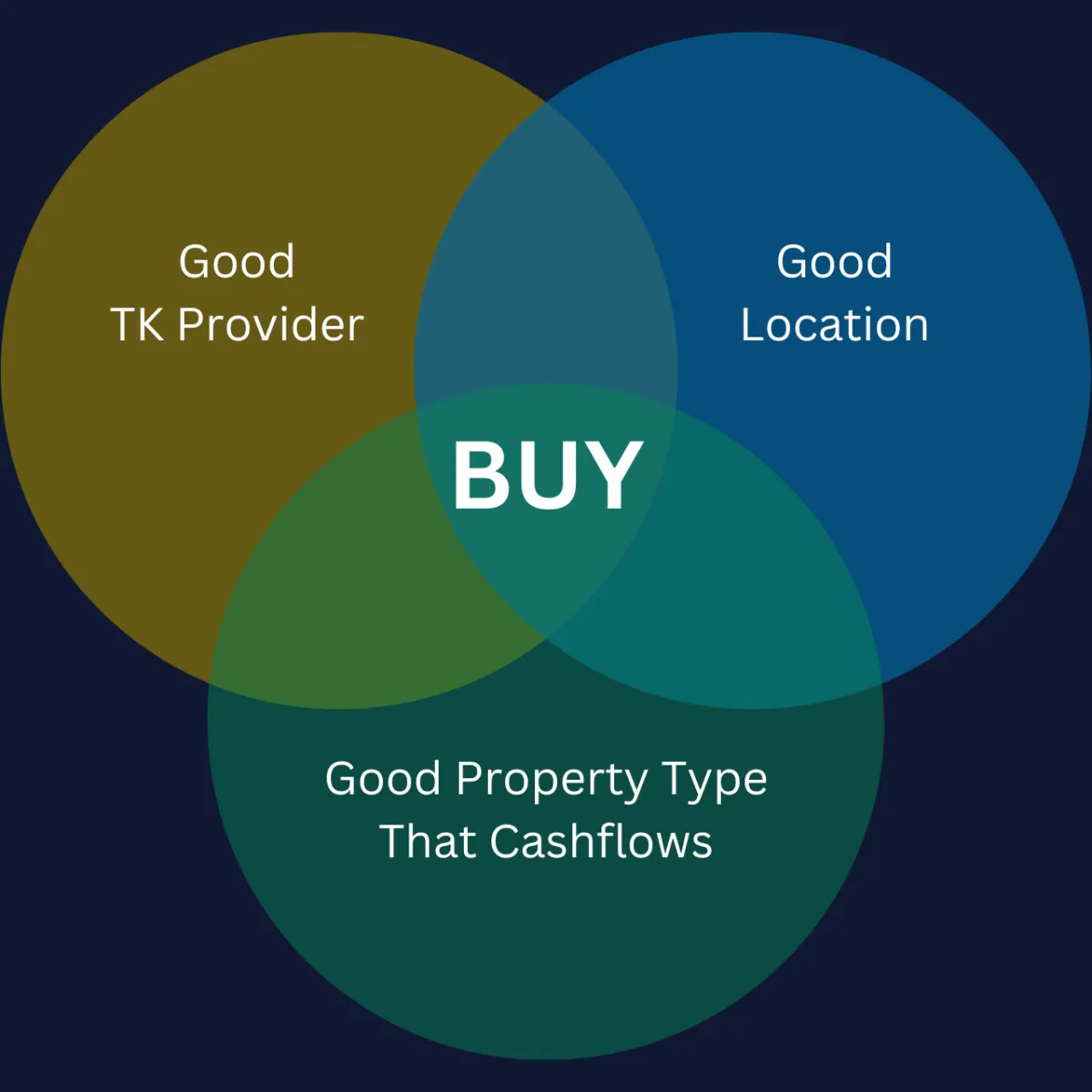

I focus on 3 things:

The Where - Location still matters!

The Who - Who we buy properties from matters!

The What - The type of property we're buying matters!

By limiting your buy box to properties that are favorable in all 3 of these areas, the probability of your asset's performance in maximized.

Because I'm not a Realtor, and I have no ties to any particular property or area or provider, I'm free to teach how to filter properties from all available sources and narrow down your options to the top 0.1% of the available inventory.

Founder & CEO of Cash-flow Engineer

Jim Beavens

WHO AM I?

Hi, I'm Jim Beavens

I'm a 29-year Computer Engineering veteran who successfully pivoted my retirement strategy to real estate by buying 6 rental properties in a span of 18 months, which now yield a combined positive cashflow of nearly $2,500/mo in passive income, all while rising in value enough to provide a total 70% return on my invested funds over the last 3 years thanks to the power of leveraged appreciation.

I’m teaching this program because when I found out how easy it is to buy income-producing properties in locations where it makes sense, I knew that more of my professional peers needed to know about this investment strategy.

There is simply NO reason that real estate investment should be limited to the super wealthy, while the rest of us give up control of our money to the whims of the stock market and external forces beyond our control!

Most high-tech professionals should be able to buy 1-2 houses per year using nothing but existing annual bonuses and stock grants, resulting in a sizeable portfolio in just 10 years' time, that will be worth far more than could be obtained through contributing to a 401(k).

This strategy is how middle class Americans can lift themselves to the next level, and create true generational wealth for their families..

So How Did I Get Here?

In my late 40s, my retirement outlook was bleak.

Life had thrown too many curveballs at me including 2 divorces, and I had eaten into my savings too much to retire using conventional accumulation investment strategies (which basically consists of saving as big a pile of cash as you can, and hoping it doesn’t run out before you die).

Eventually, I was turned on to the out-of-state turnkey real estate investing model.

These are freshly rehabbed houses, with all major systems updated, often already leased with a tenant, and professional property management already in place.

All being sold at a reasonable price, with rental amounts that provide a comfortable positive cashflow.

Totally turnkey investments, which provide immediate passive income.

Needless to say, I was very intrigued!

But I felt ALL the fears.

Being on my own with no support to help alleviate these fears, I decided to fly out and visit a market personally.

I flew to two popular turnkey markets, and met with multiple turnkey providers, property managers, and realtors, and drove around the neighborhoods to see them for myself.

That trip changed EVERYTHING for me.

My fears were replaced with confidence. I knew which zip codes I liked, and which ones I didn’t like. I had a short list of turnkey providers and property managers I was excited to work with.

I knew who to buy from, where to buy, and what kind of property was best in each area.

I felt confident enough to purchase my first out-of-state rental property, and over the following year I bought 5 more (with many more planned in my future!). All my investments in that area have performed very well.

But then I hit a speedbump…

During the extremely tough inventory shortage during Covid, I turned to a new market using a highly respected turnkey provider and property manager with an excellent reputation.

After my prior success, I thought I had it all figured out and decided not to visit this new market, and bought a smaller house in an area I had never seen, and wasn’t familiar with.

There were problems almost from the day I bought it. The tenant went many months without paying rent, and I eventually evicted him and paid a hefty cost to get the house make-ready again.

The truth is, nothing is guaranteed in real estate. You never know when you’ll run into a major problem (which is why I teach how important it is to have sufficient reserves to weather any storm).

But I didn’t help matters by buying in a questionable area, and buying a smaller 3bed/1bath property that was the same as every other home in the area, which did nothing to set it apart for high-quality tenants in this marginal neighborhood.

Even though I was buying from a good turnkey provider, that by itself is no guarantee that a property is a winner.

Meanwhile, I was also hearing from other investors in other investor groups that were having trouble in my first market and struggling with management problems.

All while I was doing GREAT there!

When asked where their property was located, most of the time it was in a zip code that I found to be very sketchy when I visited.

Of course, they had no clue, because they'd never seen the area in person before.

They experienced the same problem that I did in my new market: They bought from a list of houses and picked one that had a good cashflow on paper in the proforma, but didn’t really know what they were buying, or where.

They basically bought a house by throwing a dart at a dart board! My engineer mind told me there has to be a better way.

As I analyzed the various successes and failures like this in these markets, I crystallized the 3 key components that all real estate investors should consider before buying an out-of-state property:

Know who you’re buying from.

Know where you’re buying.

Know what type of property is in high rental demand in a given area.

There are many turnkey providers and marketers out there, and they all have a long list of houses to sell you.

But if you can narrow down your buy box to specific areas, limit yourself to known good providers, and know what kind of property works best in a specific area, your chances of buying a successful investment are greatly increased.

I started Cashflow Engineers because I want to make available my knowledge, experience, and market research that I wish I had when I got started—all to help people in this community BUY RIGHT.

As we continue growing the Cashflow Engineers community, I look forward to the tremendous value that we’ll create for each other as we continue pooling our knowledge, experience, and research. I hope you’ll come join us!

What Can You Expect From This Program?

After going through this program, you’ll be enabled to confidently buy cashflowing properties in attractive out-of-state markets.

You'll be empowered to get your first property under contract within several weeks.

And once you get your first one under your belt, there will be nothing stopping you from scaling as large of a portfolio as you want, limited only by your available investment capital.

" Testimonials"

People that have gone through this program and taken action have had tremendous success. In the last live cohort with a small group of investors, 8 people successfully acquired their first out-of-state rental property within 6 weeks, and several have gone on to buy their 2nd, 3rd, 4th, even 5th property. One member went all in and sold their Oregon property and utilized its substantial equity to do a 1031 exchange into 13 more affordable out-of-state properties, increasing their monthly cashflow by nearly 400%!!!

Hear from some of these members in their own words:

- Suddha T.

“I was intrigued a couple of years ago when Jim posted about his real estate adventure on LinkedIn and how he was scaling his business. So, end of last year when Jim put out the word that he was going to get together a set of like minded engineers and teach us about ‘cash flow’ properties - I was ecstatic. I was the first to join his group and embarked on the journey from middle of January. The 6 weeks lesson was thorough and in depth where Jim explained and walked us step by step through the entire process. But it wasn’t just lessons - we were actively evaluating, putting in offers, setting up llc and understanding the concept of vault. And with like minded engineers who were all in this together, the community was very helpful in bouncing off ideas from each other and shared experiences. I would never feel comfortable taking this risk without Jim’s guidance and help in every step of the process. And unlike other real estate training materials, this was in-depth, no marketing gimmicks and a true engineering execution project. I put in an offer within 3 weeks of joining and last month closed on the deal. Already looking to my second and scaling up my real estate portfolio. Thank you Jim for opening this door for us.”

- Vignesh K.

“Highly recommend taking Jim's Cashflow Engineer's course. I was able to close on an out of state property confidently by end the course based on his coaching and contacts that he provided. Looking to add more to the portfolio and grow following Jim's footsteps”.

- Badarish A.

“I came across Jim and his Cashflow engineers course through a mutual connection. My interaction with Jim right from the introductory call to this point after taking his course has been extremely positive. Jim is a very helpful person and his course Cashflow engineers provides you with the tool to dive deep into out of state real estate investment. In fact, I went from having zero idea of how to go about rental real estate investment to now having the confidence to be able to close on properties within a span of few months.I would recommend Jim as a very capable and helpful resource to anyone wanting to learn about rental real estate investment.”

PROGRAM CONTENTS

The flagship program inside the Turnkey Mastery System is the “6 Weeks to Cashflow Challenge”. In this program, you’ll learn all about the following over these 6 modules:

Financing - Including recommendations for experienced national lenders who specialize in investment loans in attractive markets.

Finding Properties & Turnkey providers- Including specific recommendations for quality turnkey providers.

Evaluating Properties and areas- Including my custom financial analysis calculator, as well as “Virtual Buying Tours” of the markets that are the most beginner-friendly, with my personal recommendations of specific neighborhoods based on my experience visiting and investing in these areas.

Property Management- Including a comprehensive vetting checklist, and recommendations for specific quality PM’s.

Asset Protection and Tax Strategies- Learn the ideal LLC setup to maximize liability protection and tax advantages.

From Contract to Closing- Learn about all the details needed prior to closing, including recommendations for inspections and insurance.

Furthermore, this knowledge will form a foundation to enable ongoing purchases to scale up a full real estate portfolio.

Finally, as you continue adding properties and stacking cashflow in a predictable way, you will see a clear path to retirement and be able to estimate when your passive income will surpass your expenses, allowing you to retire comfortably at an early age.

By the end of this program, you’ll know everything needed to get your first out-of-state rental property under contract, and do so with confidence.

If I offered you a proven educational and coaching program that included . .

...A step-by-step process for easily finding, analyzing, and buying out-of-state rental properties,

...Specific recommendations of property providers with a proven track record,

...Detailed analysis of specific locations to target, and ones to avoid when buying a property,

...all to reduce the overall risk of buying remote investment properties,

...for a price that's less than what you'd pay in closing costs on a single property,

And it didn’t require you to divert excessive time or energy away from a demanding career….

Would you take me up on my offer?

See why our students consider this program a bargain to transform their financial future and start on a path to early retirement.

Normally when you buy a house, you pay closing costs of $6,000-$8,000 on top of the purchase price, to cover the various fees, taxes, and services you’ve received as part of the buying process.

Which sounds excessive, and yet we do it anyway…because we know that the long-term benefit of this investment will dwarf this up-front cost over the long run.

Well, this program is very similar. You’re making an initial investment in an unbiased education and coaching program that will instill in you the confidence to buy your first cashflowing property.

And between the cashflow and leveraged appreciation, you will likely recoup the cost of this program well within the first year of owning one property,

But what you’ll learn in this program doesn’t just apply to your first property purchase…

…but for every property you buy moving forward, and for every new addition to your portfolio in the future. Because…

YOU CAN APPLY EVERYTHING YOU LEARN ABOUT BUYING OUT-OF-STATE CASHFLOWING REAL ESTATE AGAIN AND AGAIN, FOREVER!

And look, the mistake that most people make when it comes to the turnkey investing model is they just focus on the numbers, and pick any house that cashflows on paper, regardless of the provider or the neighborhood. But let me ask you…

If you don’t know how desirable an area is for renters, or how reliable the turnkey provider is, or how competent the property manager is, how will you know if this property is really going to perform like it says on paper?

Sure, you can take the plunge and learn for yourself. But if the rehab quality is shoddy, or if the home goes unrented for months after your purchase, or if a bad tenant is placed that doesn’t pay, you could be on the hook for thousands of dollars in mortgage payments, evictions, and make-ready costs.

Wouldn’t it be safer to leverage the experience, research, and recommendations of somebody who’s actually invested in these markets, and is willing to share every juicy detail about markets, neighborhoods, turnkey providers and property managers, both good and bad?

Don’t get me wrong; real estate always carries risks, and things can always go south even if you do everything perfectly. But your goal when you buy should be to minimize the chances of anything going south with your investment, which could cost you thousands of dollars and kill your cashflow. And that's exactly what this program is designed to do: minimize and mitigate your risk.

So that leads me to how much the investment is to get your hands on this system…

If you wanted to partner with me 1:1 where I would do all the legwork to find, analyze, and reserve properties on your behalf, you would need to invest a minimum of $10,000 to have me start building your portfolio for you.

And you’re about to learn everything that I do myself when buying properties…for a fraction of that price!

The Turnkey Mastery System is a $2,997 investment for lifetime membership, with unlimited access to the group coaching, community, and recordings for as long as you’d like. There is also a payment plan available, with just $597 due today to get started.

At this price, it’s a no-brainer. Why? Because for less than the price of the closing cost for a single house, you’ll gain a foundation of knowledge and research that you can use again and again, on EVERY investment home you purchase, to minimize risk and give you confidence to scale a portfolio that will grow equity and cashflow FAR beyond this initial investment.

ENROLL IN

THE TURNKEY MASTERY SYSTEM

TODAY!

Just 6 installments of

$597

(Just $597 today)

Or Save $585 When You Pay In Full Today!

Act Now! This is the PERFECT Time to Get Started!

There are multiple reasons to act now and join the Cashflow Engineers community.

Joining now will get you immediate access to all of the recordings of the ‘6 Weeks to Cashflow Challenge’. This is the exact same material that enabled multiple people to get their first out-of-state property under contract, and will empower you to do so as well.

Furthermore, you'll get access to frequent market updates that expand on this recorded material with current market conditions.

The real reason to act now is simple: This is a GREAT time to buy real estate!

I know what you’re thinking: “That’s nuts, interest rates are crazy high right now!”

On a first order, yes, interest rates have severely cut into the year-one of many investments.

But inflation is very real, and once I teach you how to do a multi-year analysis several years into the future, you'll see that year-one cashflow is probably the least important factor in measuring your investment's potential.

Furthermore, there are many 2nd-order effects that are huge benefits to investors right now who are continuing to buy and add to their portfolio.

These benefits include:

Much less competition to buy. No more bidding wars. Some sellers are actually motivated and offering deals.

Experienced buyers are taking a break on the sideline, sitting fat and happy after engorging on properties during Covid. This is actually a perfect time for new investors to get started in a market that is much more sane and forgiving than a couple years ago.

Many turnkey providers have inventory piling up and are offering incentives to attract investors, including closing cost credits, and in some cases completely waiving the property management fee for 2 years. In many cases, these combined incentives result in a net cash-on-cash return that is comparable to the last couple years of lower rates.

When rates finally do go down after the next Fed overreaction to some crisis, you want to already be owning properties, not buying along with everybody else. Buying properties is hard when rates are low and everybody wants in. But if you already own properties when rates go down, that’s when true wealth is made, as prices rise due to increased demand, enabling you to pull out massive equity tax-free through cash-out refi’s.

Bottom line: Don’t wait to buy real estate. Instead, buy real estate and wait.

Jump in today to the ‘TURNKEY mastery system’ to get started on securing a financially free future sooner than you ever thought possible!